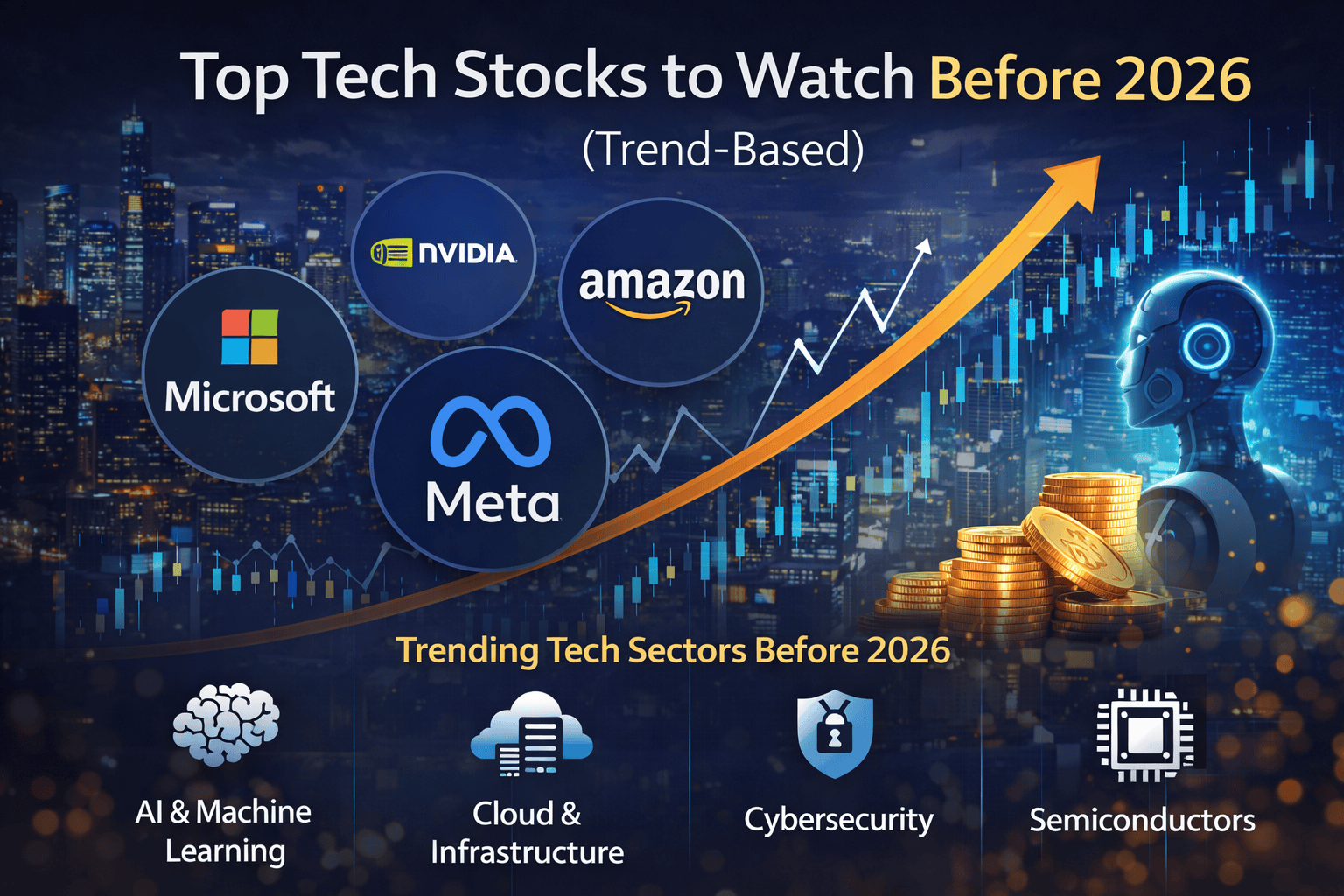

The technology sector continues to shape global markets, consumer behavior, and enterprise transformation. As we approach 2026, investors are increasingly shifting focus from short-term hype to trend-driven, long-term value creation.

Rather than chasing daily price movements, a trend-based approach looks at structural shifts—artificial intelligence, cloud infrastructure, cybersecurity, semiconductors, and platform monetization—that are likely to define the next phase of growth.

This article highlights key tech stock categories and leading companies to watch before 2026, based on market trends, adoption signals, and strategic positioning.

Note: This article is for educational and informational purposes only and does not constitute investment advice.

Why a Trend-Based Approach Matters Before 2026

Markets reward companies that align with multi-year technology adoption cycles, not just quarterly momentum. As we move into 2026, several forces are converging:

- Enterprise-wide AI deployment

- Increased cloud and data infrastructure spending

- Heightened cybersecurity risk and regulation

- Growing demand for advanced computing power

- Platform consolidation and monetization maturity

Trend-based stock analysis helps readers understand why certain companies matter, not just how they performed in the past.

1. Artificial Intelligence Leaders

Why AI Stocks Remain Critical

AI is no longer experimental. It is now embedded across:

- Enterprise software

- Customer support

- Marketing and advertising

- Healthcare diagnostics

- Financial services

Companies that provide AI platforms, infrastructure, or monetization layers are positioned for sustained demand.

Tech Stocks to Watch

- NVIDIA (NVDA) – AI chips and data center dominance

- Microsoft (MSFT) – Enterprise AI integration through cloud and productivity tools

- Alphabet (GOOGL) – AI-driven search, advertising, and cloud services

Trend Signal

AI spending is shifting from experimentation to core budget allocation, increasing revenue predictability for market leaders.

2. Cloud Computing and Enterprise Infrastructure

Why Cloud Still Has Room to Grow

Despite years of adoption, many enterprises are still mid-transition to:

- Hybrid cloud

- Multi-cloud environments

- AI-optimized infrastructure

Cloud providers with strong enterprise relationships and scalable platforms remain well-positioned.

Tech Stocks to Watch

- Amazon (AMZN) – AWS remains the backbone of global cloud infrastructure

- Microsoft (MSFT) – Azure’s integration with enterprise software is a major advantage

- Oracle (ORCL) – Increasing traction in cloud databases and enterprise migration

Trend Signal

Cloud spending is becoming mission-critical, not discretionary, especially for AI workloads.

3. Cybersecurity Companies

Why Cybersecurity Demand Is Accelerating

Cyber threats are increasing in frequency, sophistication, and cost. At the same time:

- Governments are tightening regulations

- Enterprises are increasing security budgets

- Cybersecurity is moving to board-level priority

This creates durable demand for security platforms.

Tech Stocks to Watch

- Palo Alto Networks (PANW) – Comprehensive enterprise security platforms

- CrowdStrike (CRWD) – Cloud-native endpoint protection

- Fortinet (FTNT) – Network security at scale

Trend Signal

Security spending remains resilient even during economic slowdowns, making cybersecurity stocks more defensive within tech.

4. Semiconductor and Advanced Computing Stocks

Why Chips Power Every Major Tech Trend

AI, cloud, EVs, automation, and IoT all depend on advanced semiconductors. As computing demands increase, so does the need for:

- High-performance chips

- Specialized processors

- Advanced manufacturing

Tech Stocks to Watch

- NVIDIA (NVDA) – AI and accelerated computing leadership

- Advanced Micro Devices (AMD) – Competitive CPUs and GPUs

- Taiwan Semiconductor Manufacturing Company (TSMC) – Global chip manufacturing backbone

Trend Signal

Compute demand is expanding faster than supply, giving pricing power to industry leaders.

5. Platform and Consumer Tech Companies

Why Platforms Still Matter

Large tech platforms continue to benefit from:

- Massive user bases

- Multiple revenue streams

- Subscription and advertising models

- AI-driven monetization improvements

While growth may be slower than in early years, profitability and cash flow remain strong.

Tech Stocks to Watch

- Apple (AAPL) – Services, ecosystem lock-in, and premium hardware

- Meta Platforms (META) – AI-driven advertising efficiency and social platforms

- Netflix (NFLX) – Subscription optimization and global content strategy

Trend Signal

Mature platforms are shifting focus from growth at all costs to operational efficiency and margin expansion.

Key Trends to Monitor Before 2026

Readers tracking tech stocks should watch for:

- AI revenue contribution in earnings reports

- Cloud and data center capex trends

- Cybersecurity contract growth

- Semiconductor supply chain stability

- Regulatory developments affecting big tech

These indicators often matter more than short-term stock price movement.

How Readers Should Use This Information

This article is designed to help readers:

- Understand why certain tech stocks matter

- Identify long-term technology trends

- Build informed watchlists

- Ask better questions before investing

Rather than reacting to headlines, readers can focus on fundamentals and adoption trends.

Risks and Considerations

Even strong technology trends carry risks:

- Valuation volatility

- Regulatory pressure

- Competitive disruption

- Macroeconomic shifts

Diversification, patience, and continuous learning remain essential.

Conclusion

As we approach 2026, the most compelling tech stocks are those aligned with long-term structural trends, not short-lived market excitement.

Artificial intelligence, cloud infrastructure, cybersecurity, semiconductors, and platform monetization are shaping the future of technology—and the companies leading these areas are worth watching closely.

For readers, the goal is not to predict exact price movements, but to understand where technology is heading and which companies are building that future.